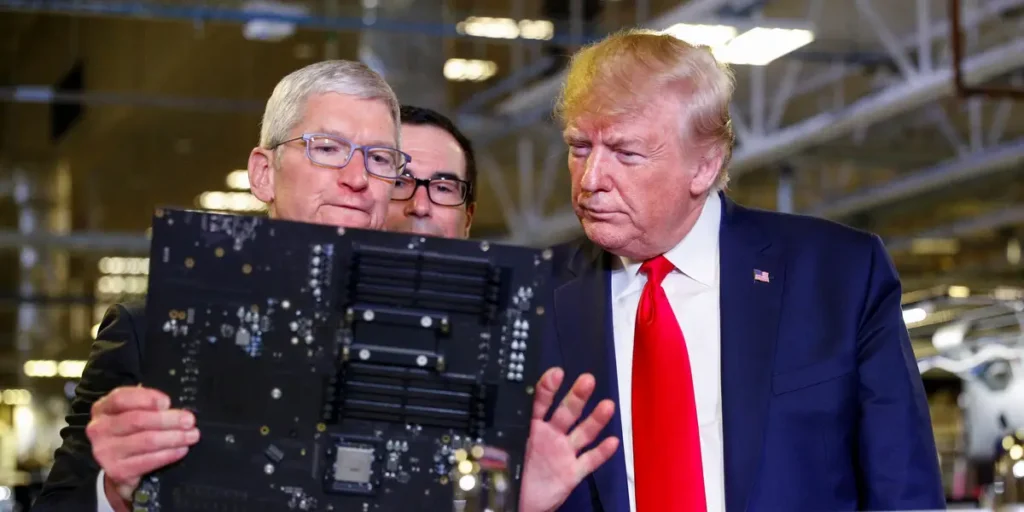

Apple’s supply chain is rapidly shifting gears as CEO Tim Cook confirmed that half of all iPhones sold in the U.S. during Q2 2025 were manufactured in India. With U.S. tariffs on Chinese imports reaching 125%, Apple is strategically minimizing shipments from China, leaning on India for iPhones and Vietnam for nearly everything else.

Foxconn plans to double India’s iPhone production to 25–30 million units by end-2025, while Tata Electronics expands assembly of older models. This shift marks a historic pivot, as India moves from a low-cost market to a primary export hub for U.S. iPhone sales. The iPhone 16e, targeting budget buyers, has been a key player in this transition.

Apple’s Q2 results impressed, with $95.4 billion revenue and $1.65 EPS, up 5% and 8% year-on-year, respectively. Despite these gains, Apple anticipates a $900 million tariff-driven cost hit in the June quarter. While exemptions and a tariff “pause” remain uncertain, customers could feel the impact by fall if rates hold.